Hey PCrunner readers, if you’re eyeing a new smartphone or notebook upgrade, brace yourself: memory chip prices are gearing up for another big jump in Q1 2026, and it’s already forcing brands to rethink their game plans. According to fresh reports from market analysts TrendForce, this surge—fueled by skyrocketing demand for AI servers and limited supply—is cranking up the bill of materials (BOM) costs for everything from budget Androids to premium ultrabooks. We’re talking DRAM and NAND Flash prices that could push overall device costs up another 5-7% (or more) on top of 2025’s already wild 75%+ YoY hikes. The ripple effect? Higher retail tags, spec downgrades, and shipment forecasts getting slashed—smartphone production down 2% YoY and notebooks off by 2.4% for 2026.

Why Memory Is the Villain Here

Memory isn’t just a side note anymore—it’s gobbling up 10-18% of a typical notebook’s BOM right now, and that’s on track to blow past 20% next year. For smartphones, it’s hitting entry-level models hardest, where DRAM is a key selling point for multitasking and storage. Brands like Xiaomi are already waving red flags, warning of price bumps for 2026 launches as they scramble to secure supplies. Over on the PC side, giants like Dell are slapping 15-20% hikes on quotes mid-December 2025, with Lenovo following suit in January 2026—blaming the DRAM crunch and AI tech integration.

Even Apple’s not immune: iPhone BOMs could see memory eat into profits big time, potentially killing off those sweet discounts on older models and jacking up new ones. Android makers in the mid-to-low end? They’re in a tougher spot, forced to hike launch prices or tweak existing lineups to avoid bleeding cash.

Spec Cuts Incoming: Less RAM, Slower Upgrades

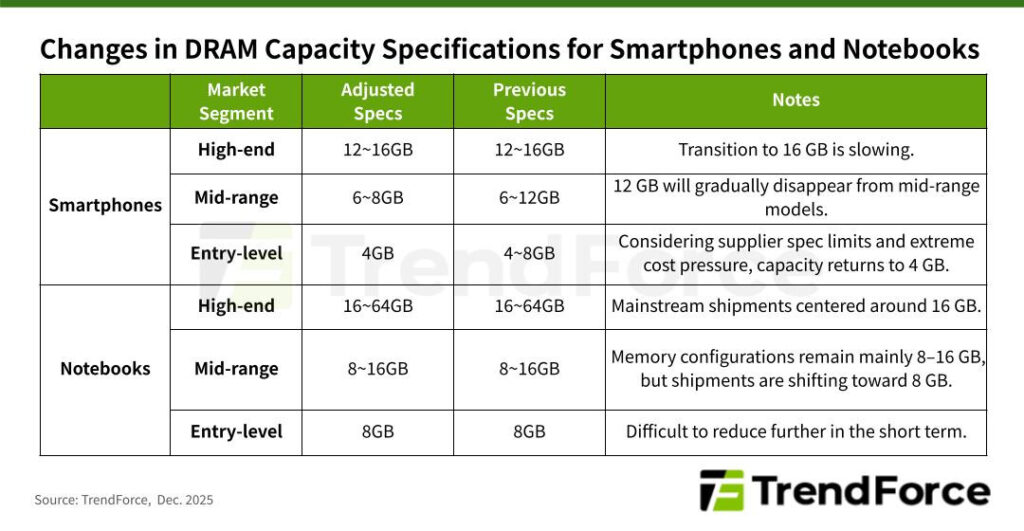

To dodge the pain, manufacturers are dialing back:

- Smartphones: High/mid-range sticking to bare-minimum DRAM (think no more generous bumps), while low-end base models might drop back to 4GB in 2026—ouch for budget gamers. Upgrade cycles? Getting longer as folks hold onto what they’ve got.

- Notebooks: Ultrathins with soldered RAM can’t swap modules easily, so expect early price pressure there. Budget rigs face OS and CPU limits, but overall, we’re looking at trimmed specs across the board by Q2 2026. Retail prices could climb 5-15%, especially in budget/mid segments, pushing buyers toward used gear or delays.

Current stockpiles of cheap memory are buying a short grace period—prices might hold steady through late 2025—but don’t count on it lasting. NAND Flash is joining the party too, with double-digit jumps expected in Q1.

What This Means for You (and the Market)

If you’re building or buying a PC, stock up on RAM modules now before the wave hits—prices for DDR5 are already up 307% since September. For phones, it might mean settling for less storage or waiting for deals that never come. Broader fallout? A sluggish consumer electronics scene amid inflation and geopolitics, with even game consoles like the Switch 2 feeling the pinch (memory at 21-23% of costs).

TrendForce warns more forecast cuts are likely if supply stays tight—keep an eye on Q4 2025 earnings for clues. Got thoughts on dodging these hikes? Drop ’em in the comments. Stay tuned to PCrunner for the latest on how this shakes out your next rig.

Source: TrendForce