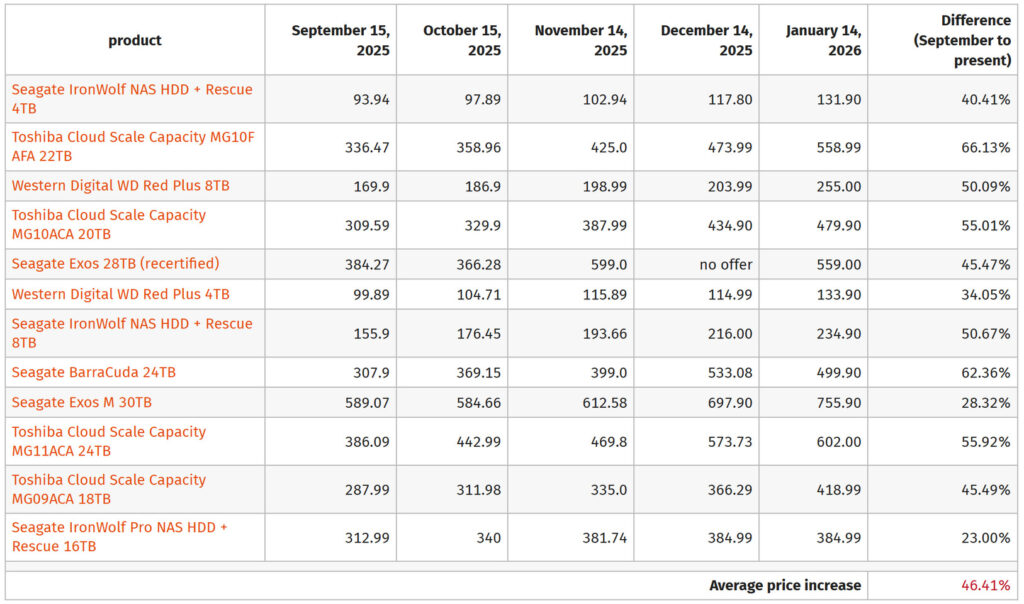

Hard disk drives (HDDs) have seen their prices climb an average of 46% since mid-September 2025, with hikes ranging from 23% on models like the Seagate IronWolf Pro 16TB NAS to a whopping 66% on the Toshiba MG10F 22TB. Tracking 12 popular EUR-listed models, ComputerBase’s data shows this demand-driven spike—without major supply shortages—making “spinning rust” nearly 50% pricier overall. December 2025’s DigiTimes report noted a 4% Q4 contract rise, the biggest in eight quarters, compounding into consumer pain as single-digit jumps multiply downstream. Unlike silicon-heavy SSDs, HDDs rely on non-shortage materials like platters, so this isn’t a raw supply crunch—it’s pure demand from AI and cloud giants.

Why the Sudden HDD Frenzy?

U.S. hyperscalers and cloud providers are snapping up high-capacity HDDs for exabyte-scale AI training, analytics, and archival—where speed takes a backseat to cost-effective bulk storage. SSD data retention worries push some workloads back to reliable HDDs, while manufacturers run at near-full capacity beyond traditional uses like surveillance. AI’s “data deluge” for model training amplifies this, with reports warning shortages could persist into 2026-2027 as factories pivot to pricier AI memory like HBM. China’s PC push and global AI buildouts collide, spiking contract prices 4% QoQ—the sharpest in years—with suppliers forecasting ongoing pressure.

Impacts for PC Users and Builders

For NAS setups or bulk storage, this means budgeting more—expect $50+ extra per drive, with delivery delays stretching to years for high-TB models. PC gamers and creators might lean harder on SSDs, but those face even steeper surges (60%+ for NAND). If you’re expanding storage, buy now—analysts like IDC see utilization rates maxed out, with AI’s “explosive demand” keeping prices elevated into 2026.

Summary of HDD Price Trends (Q4 2025 to Jan 2026)

| Model/Aspect | Price Increase | Key Drivers | Notes |

|---|---|---|---|

| Average Across 12 Models | 46% (Sep-Jan) | AI/cloud demand, no supply shortage | Consumer prices compound contract hikes |

| Seagate IronWolf Pro 16TB | 23% (lowest) | High-capacity NAS demand | Stable but rising |

| Toshiba MG10F 22TB | 66% (highest) | Enterprise/hyperscaler procurement | Exabyte-scale AI archival |

| Overall Contract (Q4 2025) | 4% QoQ | Largest in 8 quarters | Accumulates to 46% retail spike |

| Forecast | Ongoing into 2026-2027 | AI buildouts, NAND pivot | Utilization near 100% |

Community Reactions: Frustration and Stockpiling

Reddit’s r/hardware laments the “apocalyptic” crunch, with users noting $100 jumps on 16TB drives since September—blaming AI for derailing NAS builds into 2026/2027. Forums warn of “storage apocalypse,” urging buys now as AI vacuums supply. If trends hold, expect broader PC impacts—time to raid your old drives?

Stocking up on HDDs or switching to SSDs? Share your storage strategy in the comments, and follow PCrunner for deals amid the crunch.